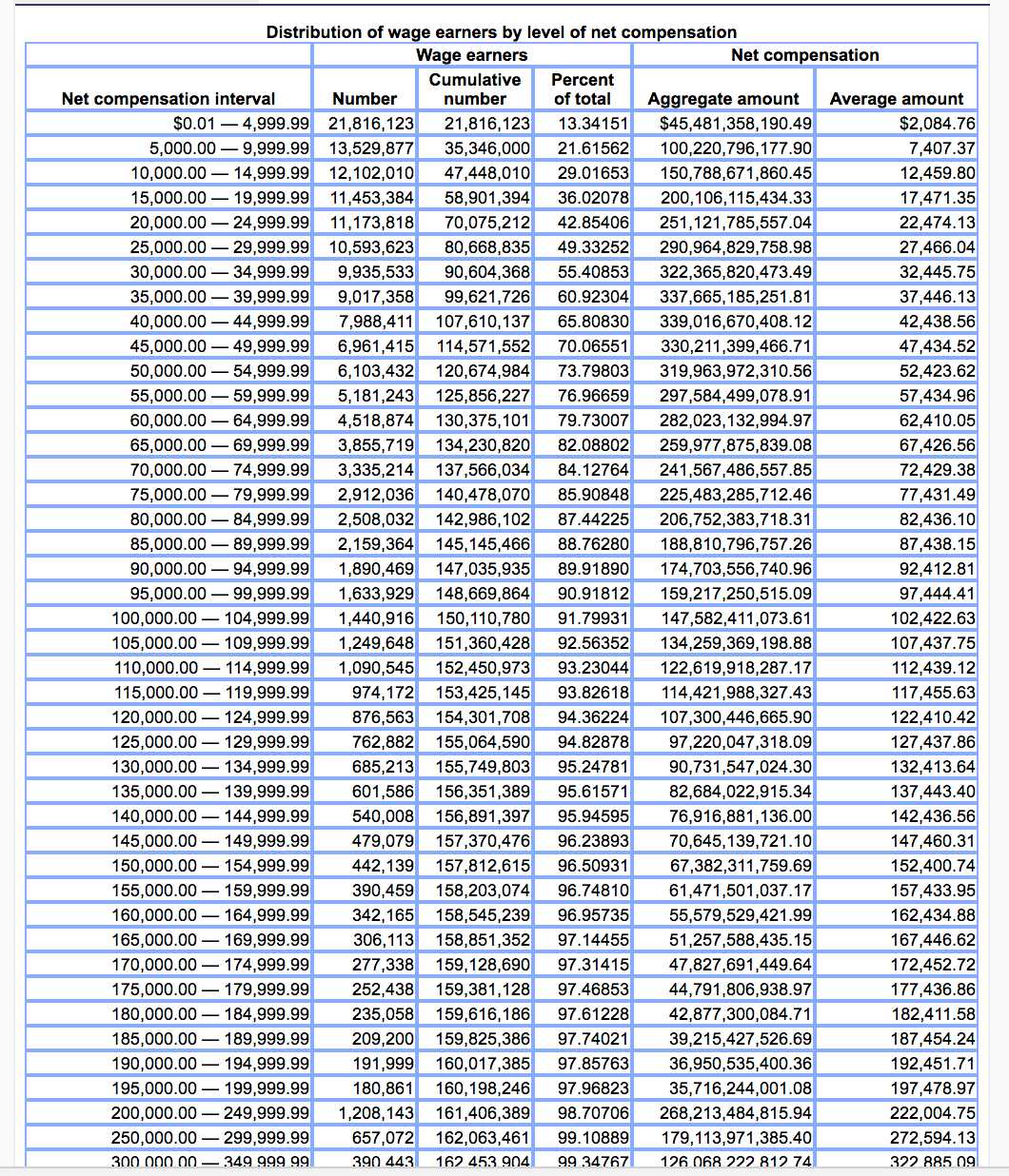

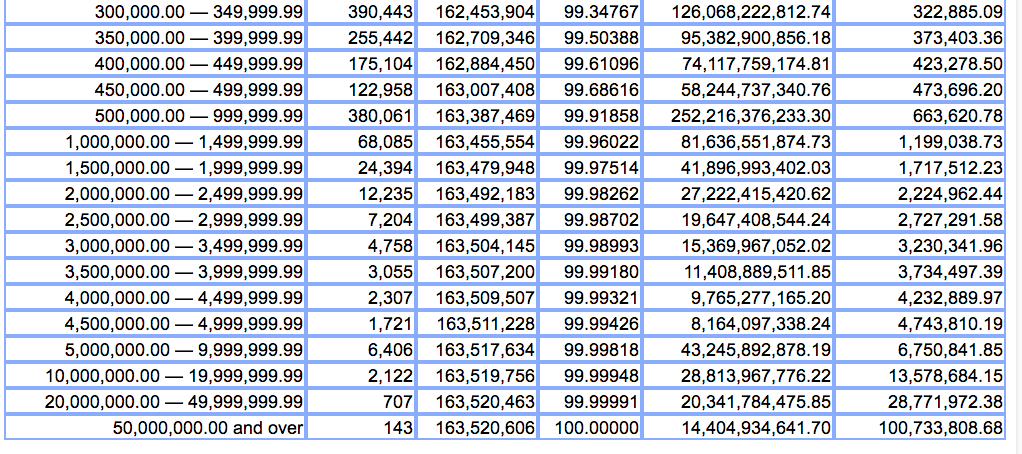

Today the Social Security Administration published wage statistics for 2015. The statistics are based on individual wage earners and not household income. For an individual to be in the top 10% of wage earners he/she needs to earn about $95,000. To be in the top 5% that amount of earnings would jump to about $130,000 and to be in the top 1% you will need to earn about $250,000. From the SSA,

The “raw” average wage, computed as net compensation divided by the number of wage earners, is $7,626,754,213,228.06 divided by 163,520,606, or $46,640.94. Based on data in the table below, about 67.3 percent of wage earners had net compensation less than or equal to the $46,640.94 raw average wage. By definition, 50 percent of wage earners had net compensation less than or equal to the median wage, which is estimated to be $30,533.31 for 2015.

(How the new tax bill will affect your taxes will be in a coming post.)

(How the new tax bill will affect your taxes will be in a coming post.)