There are many ways to tally the “top” universities. One is to measure an institution’s prestige or reputation. Another is to capture the educational value added based on metrics of cost, salary after graduation, and return on investment. Yet another is to rank universities by their success in promoting upward social mobility.

The U.S. News & World-Report, which basically measures reputation, is the best known. The Wall Street Journal tracks return on investment.

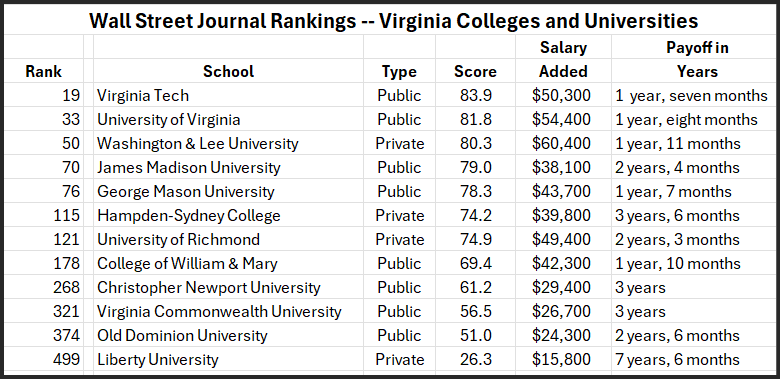

As much as it pains me to draw peoples’ attention to the fact, Virginia Tech outranks the University of Virginia in the latest WSJ ranking.

The outcomes of rankings like this hinge on the factors considered and the relative weight apportioned to those factors. Methodology is everything. The WSJ does not track students’ intellectual growth, development as informed citizens, or transformation into social-justice crusaders. It’s all about the Benjamins.

If you have priorities other than getting a good monetary return on investment, this is not the ranking for you. But if you’ve concluded that a lot of what kids are learning in college these days is bunk and you view college as a necessity for getting the skills and credentials to enter a good career, then this is what you’re looking for.

Virginia Tech excels in its “salary impact” score and its “graduation rate” score. It also fares well in student recommendations. The average net price of attendance (sticker price adjusted for financial aid) is $20,300. On average, graduates can expect to add $50,300 annually to their salaries. The payback for a four-year education is one year, seven months.

Here’s what goes into the WSJ ranking:

One-third of the score reflects an institution’s “salary impact” (the extent to which an institution boosts students’ post-graduation salaries beyond what they would be expected to earn regardless of the institution they attend), and another 17% reflecting the time it takes to pay off the net price of attendance.

(Based on the data in the individual university profiles, it looks like the net price is for in-state students. Average net price of $23,100 for a UVA undergrad? Trust me, that’s in-state. Depending upon year and discipline, some out-of-state students pay up to $80,000.) Because out-of-state tuition at public institutions is so much higher, the return will vary widely between in-state and out-of-state students. Accordingly, the WSJ’s statistical bias would seem to favor public universities over private.)

The WSJ gives a 10% weight to graduation rates. Universities with high graduation rates fare better than those with large drop-out rates. For dropouts, obviously, the educational return on investment is negative.

Another 20% covers learning opportunities, preparation for career, student satisfaction with learning facilities, student recommendations, and student assessments of whether an institution helps build character.

Finally, WSJ assigns a 10% weight to diversity — opportunities to interact with students of different ethnic and socioeconomic backgrounds, with a bump for inclusion of students with disabilities.

Interact with the WSJ database here.

(Reprinted from the excellent Virginia blog BaconsRebellion.com)