The $2.4 billion shortfall that Governor Terry McAuliffe announced a few weeks ago is vanishing among positive economic news from his own Secretary of Finance Ric Brown. The news of increased tax revenues in Virginia is buttressed by corresponding parallel trends at the federal level, according to reports just released by the U.S. Department of Commerce and as reported in yesterday’s Wall Street Journal.[read_more]

It was puzzling to hear the Governor report that Virginia is facing such a large shortfall when our main economic indicators are positive. And despite challenging economic times, Virginia has had a surplus every one of the last four years. In fact, last year we had a surplus of $879 million! In 2012 we realized a $448 million surplus, in 2011 a $545 million surplus and in 2010 a $403 million surplus.

It is highly unusual for budget analysts to be this far off on revenue projections and how could we be so short on tax revenue, especially when the General Assembly just last year enacted the largest tax increase in Virginia’s history? We should be flush with tax revenue—and we’d better be—because families are sacrificing hard-earned dollars to fuel that tax increase.

The Governor blames the alleged shortfall on federal budget sequestration, which he extrapolates to job losses, lower income, and reduced income tax revenue in Virginia. Sequestration has been a struggle since 2011, and yet we’ve still had surpluses. Further, not only is this concern inconsistent with other years of sequestration, it is inconsistent with the administration’s own data that show large increases in tax revenues in the first two months of this fiscal year. The Governor’s own Finance Secretary reported in a letter to the Governor that total revenue collections are up 7.7% this August compared with the same period last year, and that we are “well ahead of the revised annual forecast growth.”

Secretary Brown’s report shows that payroll employment rose in August, and revised numbers for July also show a rise. The report further states that the “underlying fundamentals should support a more robust expansion over the coming year.”

His report jibes with one released by the U.S. Department of the Treasury, that similarly reflects a national trend toward rising tax receipts. The federal government has taken in record revenues. “The largest share of the tax revenue so far this year has come from individual income taxes, which totaled $1,233,274,000,000 in the first 11 months of fiscal 2014.”

The only other source of the alleged shortfall cited by the Governor relates to non-withholding revenues (taxes paid periodically directly by the taxpayer such as capital gains). According to the Governor, his experts estimated incorrectly for these revenues, which produced a $400 million shortfall in that category alone. Budget analysts are well aware that these revenues are highly volatile. Hence, a common tactic to “shape” a budget is to tweak these estimates. Budget experts can underestimate growth and indicate a surplus, or overestimate to produce a shortfall. In fact, this whole “shortfall” discussion is based on a committee (appointed by the Governor) recommending an adjustment to revenue projections.

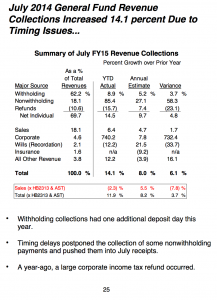

Nevertheless a closer look at Secretary Brown’s presentation shows on page 25 that the $400 million non-withholding shortfall was due to a “timing delay” in reporting June receipts, which was the last month of FY14. The receipts were instead counted in July (our current fiscal year) and sure enough, revenue totals show a year-to-date 85% increase in that revenue stream.

Our rainy day fund is also flush with cash above the required balance – over $1 billion in cash! Current reserves show $687.5 million and $243.2 million for FY15. Strangely, the reserves for FY16 were not reported but most likely hold hundreds of millions of dollars as well.

Setting aside for the moment the question of why the Governor seems to be alarmist about what would ordinarily be good news, our actual revenue numbers in Virginia show that we are well ahead of our projected revenue, and that the underlying fundamentals of the economy continue to signal growth, suggesting that cautious optimism is warranted. All of this is fantastic news in terms of the concern we may have about an alleged $2.4 billion shortfall.

Instead of talking about shortfalls, maybe it’s time to start talking about tax cuts.