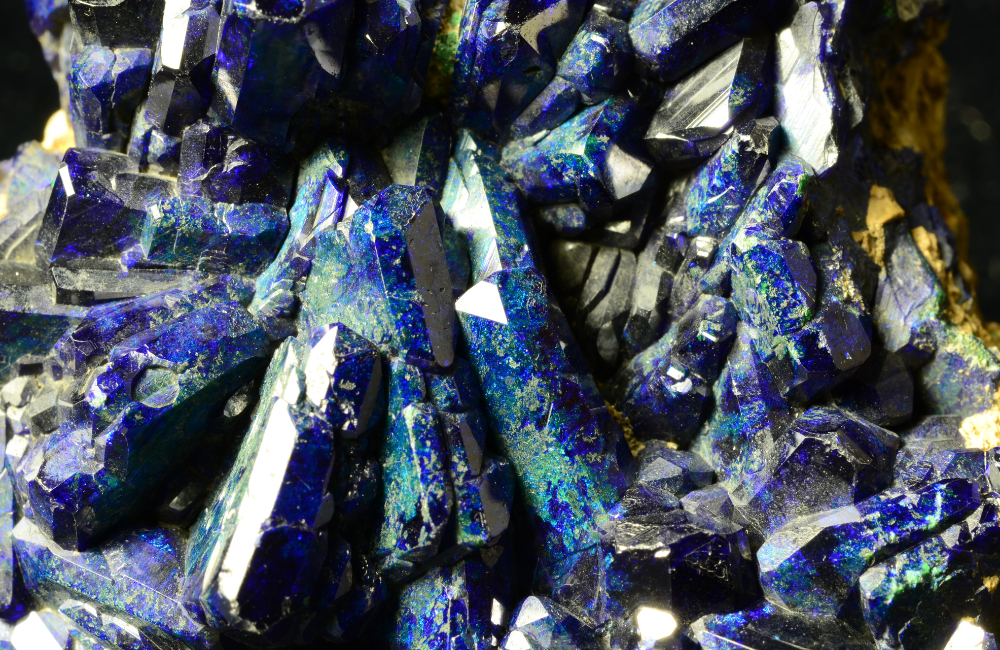

In the high-stakes game of global power, rare earth minerals have emerged as a critical battleground. These 17 obscure elements—names like neodymium, dysprosium, and cerium—aren’t household terms, but they’re the backbone of modern technology. From smartphones and electric vehicles to wind turbines and missile guidance systems, rare earths are indispensable. For America, securing these resources isn’t just an economic priority—it’s a national security necessity, especially as China tightens its grip on the global supply chain. Enter Donald Trump, whose transactional approach to foreign policy has spotlighted Ukraine’s mineral wealth and Greenland’s untapped deposits as key pieces in this geopolitical chess match.

Why Rare Earths Matter to America

Rare earth minerals are the unsung heroes of the 21st-century economy. They’re essential for manufacturing the magnets that power electric motors, the batteries that store renewable energy, and the advanced electronics that keep our military cutting-edge. The F-35 fighter jet, for instance, relies on rare earths for its sensors and stealth capabilities. Without these materials, America’s technological edge—and its ability to defend itself—crumbles.

The problem? China controls the board. Producing about 60% of the world’s rare earths and processing nearly 90%, Beijing has a stranglehold on the market. In 2023, the U.S. imported $190 million worth of rare earth compounds, with 80% of its needs met by China and a handful of other countries like Malaysia and Japan. This dependency is a glaring vulnerability. China has already shown it’s willing to weaponize its dominance—recall 2010, when it cut off rare earth exports to Japan over a territorial spat, sending shockwaves through global markets. With Trump threatening tariffs and a trade war, Beijing’s recent export controls on critical minerals like tungsten and molybdenum signal it’s ready to flex that muscle again.

For America, breaking this reliance isn’t optional—it’s existential. The Biden years saw rhetoric about diversifying supply chains, but little action. Trump, however, sees the world through a dealmaker’s lens: if China’s got the goods, America needs to find its own stash. That’s where Ukraine and Greenland come in.

Trump’s Play for Ukraine’s Minerals

Since taking office in January, Trump has wasted no time pushing a bold agenda to end the Russia-Ukraine war while securing American interests. A centerpiece of his strategy? Ukraine’s rare earths and critical minerals. On February 3, he told reporters, “We’re putting in hundreds of billions of dollars. They have great rare earths, and I want security of the rare earth, and they’re willing to do it.” Days later, he upped the ante on Fox News, claiming Ukraine had “essentially agreed” to hand over $500 billion worth of minerals as payback for U.S. aid.

Ukraine’s not a rare earth giant like China—its reserves are modest compared to the 44 million tons Beijing boasts. But it’s a mineral treasure trove nonetheless. The country holds deposits of 22 of the 34 minerals the EU deems critical, including titanium (Europe’s largest reserves), lithium, graphite, and uranium. These aren’t just rare earths but a broader suite of strategic materials vital for aerospace, green tech, and nuclear power. Problem is, many of these deposits sit in eastern Ukraine, where Russian forces have dug in since 2022.

Trump’s pitch is classic Art of the Deal: America’s shelled out over $174 billion in aid since the war began (per Congressional Research Service figures), far outpacing Europe’s contributions. Why not get something tangible in return? His team floated a jaw-dropping proposal this month—50% U.S. ownership of Ukraine’s rare earths, with American troops potentially guarding the sites post-peace deal. Ukrainian President Volodymyr Zelensky, eyeing continued U.S. support, didn’t sign on the spot but signaled openness, tying it to his “victory plan” for economic recovery and Western investment.

The stakes are clear. If Ukraine falls further into Russia’s orbit, those minerals could flow to Moscow and its ally, China, deepening America’s supply chain woes. Trump’s not just negotiating aid—he’s aiming to lock down resources that keep the U.S. in the fight against Beijing’s dominance.

Greenland: The Arctic Prize

Then there’s Greenland, the icy island Trump’s been obsessed with since 2019, when he first floated buying it from Denmark. Back then, the world laughed it off as a real estate fantasy. Today, it’s no joke. On January 7, Trump doubled down, calling U.S. control an “absolute necessity” for economic security, even hinting at military or economic coercion. Why the fixation? Rare earths, again.

Greenland sits on some of the world’s largest undeveloped rare earth deposits, like the Kvanefjeld project, packed with neodymium and uranium. Experts estimate its mineral wealth could rival China’s in potential, though extraction’s a beast thanks to ice and logistics. Add its strategic perch in the Arctic—perfect for monitoring Russia and securing shipping lanes—and you’ve got a prize Washington can’t ignore.

China’s already sniffing around. Shenghe Resources, a Chinese state-linked firm, holds a 12% stake in Kvanefjeld’s developer, Greenland Minerals. Trump’s team sees this as a red flag. National Security Advisor Michael Waltz told Fox News in January, “This is about critical minerals… It’s all part of the America First agenda.” If China gains a foothold, America’s rare earth deficit grows. Controlling Greenland could flip the script, giving the U.S. a domestic-ish source (it’s Danish territory, but closer to North America) and a military edge.

Denmark’s not selling, of course—Prime Minister Mette Frederiksen shot down Trump’s latest musings with a firm “Greenland is not for sale.” But the U.S. isn’t giving up. A 2020 memorandum with Greenland opened doors for mining cooperation, and Trump’s pressure could force Copenhagen to rethink its stance, especially if NATO ties come into play.

Competing with China: The Big Picture

This isn’t just about Trump’s dealmaking flair—it’s about America’s survival in a world where China holds the economic high ground. The U.S. has some rare earth deposits—California’s Mountain Pass mine is a start—but it’s a drop in the bucket. Processing capacity lags even worse, with China filing thousands of patents that box out competitors. Trump’s Ukraine and Greenland gambits are a counterpunch: secure alternative supplies, build leverage, and keep Beijing from calling the shots.

Critics cry imperialism, but the reality’s starker. If America doesn’t act, China’s monopoly tightens. A trade war’s brewing—Trump’s tariffs are already sparking retaliation—and rare earths could be the next flashpoint. Ukraine’s minerals and Greenland’s deposits aren’t just assets; they’re lifelines to keep America’s tech and defense sectors humming.

Trump’s approach is unorthodox, sure. But in a game where China’s playing hardball, his focus on rare earths might just be the bold move America needs. The question is whether he can pull it off—or if the world’s laughing at another “crazy idea” that’s dead serious.

1 comment

Well reasoned and well said.