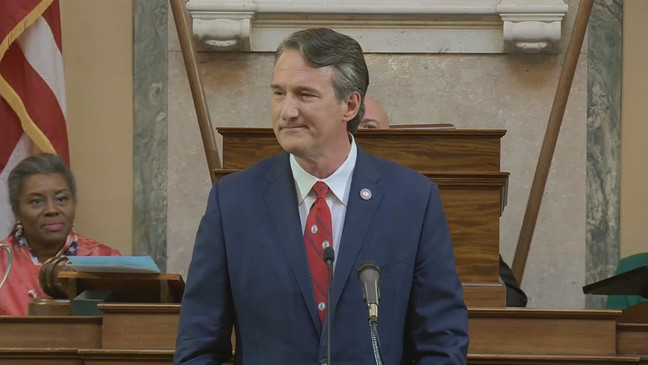

Virginia’s progressive legislature passed a bill to allow all counties to raise the sales tax by 1%. It was vetoed by Governor Glenn Youngkin (R). If it had become law, taxes would have risen further in Virginia, a state that is now one of the eight highest-taxed states, according to the Tax Foundation.

The legislature attempted to override his veto, but fell short of the two-thirds vote needed to do so, in a 25-to-15 vote in the state senate. Analysts said most local governments would have raised their sales tax had the bill become law. That’s because local sales taxes are paid partly by non-residents, giving municipalities an incentive to tax each other’s citizens by raising the sales tax. If a municipality raises its local sales tax, it keeps all of the revenue, but its residents don’t pay all of the cost — people from outside the municipality who can’t vote against the tax do.

The Virginia Mercury reports:

Local governments will have to find other ways of funding school construction and modernization costs after Gov. Glenn Youngkin vetoed legislation on Monday that would have allowed them to impose a 1% sales tax for such projects.

Under the bill, local governments could only impose the 1% sales tax if voters approved the tax in a referendum.

While Youngkin said school construction is a “worthy cause,” Virginia has taken significant measures to address school construction costs, he added, and citizens should not be paying additional taxes — especially $1.5 billion annually that would be generated from the 1% sales tax.

“The commonwealth should pursue a tax policy that unleashes economic development and prioritizes job and wage growth through innovative reforms,” said Youngkin in his veto. “These reforms must allow hardworking Virginians to keep more of their money, not less; any proposal that increases the cost of living and the cost of business is not a policy we should pursue.”

Since Virginia is a Dillon rule state, local governments are only allowed to exercise powers the legislature has specifically authorized them to have. While localities have control over adjustments to their property tax rates, they aren’t allowed to change the sales tax rate without explicit permission from the General Assembly.

Currently, state law only allows nine localities — the counties of Charlotte, Gloucester, Halifax, Henry, Mecklenburg, Northampton, Patrick and Pittsylvania and the city of Danville — to impose a 1% sales tax to fund school construction and renovation projects. Similar legislation to add the city of Newport News and the counties of Prince Edward and Stafford to the list failed during the last legislative session….Youngkin also pointed out that the bill would’ve allowed localities to use the sales tax revenue for purposes beyond funding school improvements.

“While the tax is dedicated to school capital costs, such as information technology, the new source of revenues would indirectly release funding for other purposes, supplanting other revenues without necessarily increasing education spending,” he said.

The 2022 state budget, the governor said, supported more than $3 billion in school construction projects through targeted assistance, formula-based school construction and modernization grants, and low-interest loans — all achieved while providing citizens over $5 billion in tax relief.

The failure of the legislature to override the governor’s veto of the sales-tax increase bill surprised many. Before the governor had vetoed it, it had passed the House of Delegates by a 68-to-28 vote, and the state senate by a 27-to-13 vote — garnering at least two-thirds of the vote in each house of the legislature. But the governor apparently convinced enough legislators to change their mind that his veto was sustained.

If it had passed, most counties would have enacted sales tax increases. “I am certain [local sales tax increases] will pass everywhere within a few years” if the state legislature allow local governments to raise the sales tax, said Stephen Haner of the Thomas Jefferson Institute for Public Policy. He noted that “if every locality adopted it (and it is hard to imagine it failing often) the [combined state and local sales tax] rates would range from 6.3% to 8% across the Commonwealth.”

Every Democratic legislator but one voted for the sales-tax increase bill, as did roughly a third of Republican legislators.

Democrats also sought “an expansion of the sales tax to digital goods and services, including purchases by Virginia businesses,” which the governor stripped out of the budget deal he reached with Democratic legislative leaders. Removing such tax increases does not leave Virginia with insufficient money to spend. Even after he removed tax increases proposed by Democrats, Governor Youngkin’s proposed compromise budget was “52% larger than the $123 billion overall budget Democrats approved four years ago when they had total control. The General Fund portion has grown 45% in just four years, from $44 to $64 billion,” notes Haner. Amazingly, Virginia’s Democratic legislators — who control the state legislature — viewed this 52% increase in spending since 2020 as far too small, and want to increase spending more rapidly.

In other news, a caucus that includes nearly half of Virginia’s Democratic legislators announced in February that it is in “profound solidarity” with the state’s criminals.

1 comment

I don’t agree with tax increases to build schools when the students coming out of public schools can’t write cursive or even return address a letter. With all the social attention it is no wonder students are being left behind.

I expected that Virginia Republicans would have come up with a voucher system (which I support) by now but I guess that is not profitable for the GOP.

Folks we can’t rely on Democrats with our public schools nor Republican Kathy Byron to spend tax dollars for “workforce development” for our future children and grandchildren.