On Wednesday House and Senator leaders agreed to a new tax bill. Some highlights from businessinsider.com:

- A less generous corporate rate cut. Republicans may cut the corporate rate to 21% from the current 35%, starting in 2018. The House and Senate versions had proposed a 20% rate. Despite making a 20% corporate rate his “red line” for a tax bill, Trump said at a meeting with the GOP leaders of the tax committees that he would sign a bill with a 21% rate.

- A lower top individual tax rate. The top individual bracket would drop to 37% from the current 39.6%. The Senate version had proposed a 38.5% rate.

- Keep the estate tax, but raise the threshold to qualify. Instead of phasing out the estate tax over time, as the House version proposes, the compromise bill would increase the threshold for an estate to qualify, to about $11 million from $5.6 million. That aligns with the Senate version.

- A 20% deduction for pass-through businesses. Pass-through businesses — in which the owner books profits as their income, like a limited liability corporation or S-corp — would get a 20% deduction on their income. This is more similar to the Senate version but less generous than its proposed 23% deduction.

- Repeal the corporate alternative minimum tax. The corporate AMT in the Senate version was a sore spot for many companies because it would have negated the effects of many popular deductions and credits, such as the research and development credit.

- Adjust the cap for the mortgage interest deduction. The cap would be lowered to $750,000 from the current $1 million. This is higher than the $500,000 cap proposed in the House version. The Senate version would have left the deduction unchanged.

- Does not include the House’s “Graduate Student Tax”: The House bill would have taxed tuition waivers for graduate students like normal income, which critics said could have crippled many universities’ graduate programs. Even some House Republicans came out against the provision. The Senate bill did not include that provision and the compromise bill will not either.

- State and local tax deduction compromise: With a nod toward appeasing House members in states with high taxes, the compromise bill would allow people to deduct up to $10,000 in state and local property taxes or the same amount of income and sales taxes.

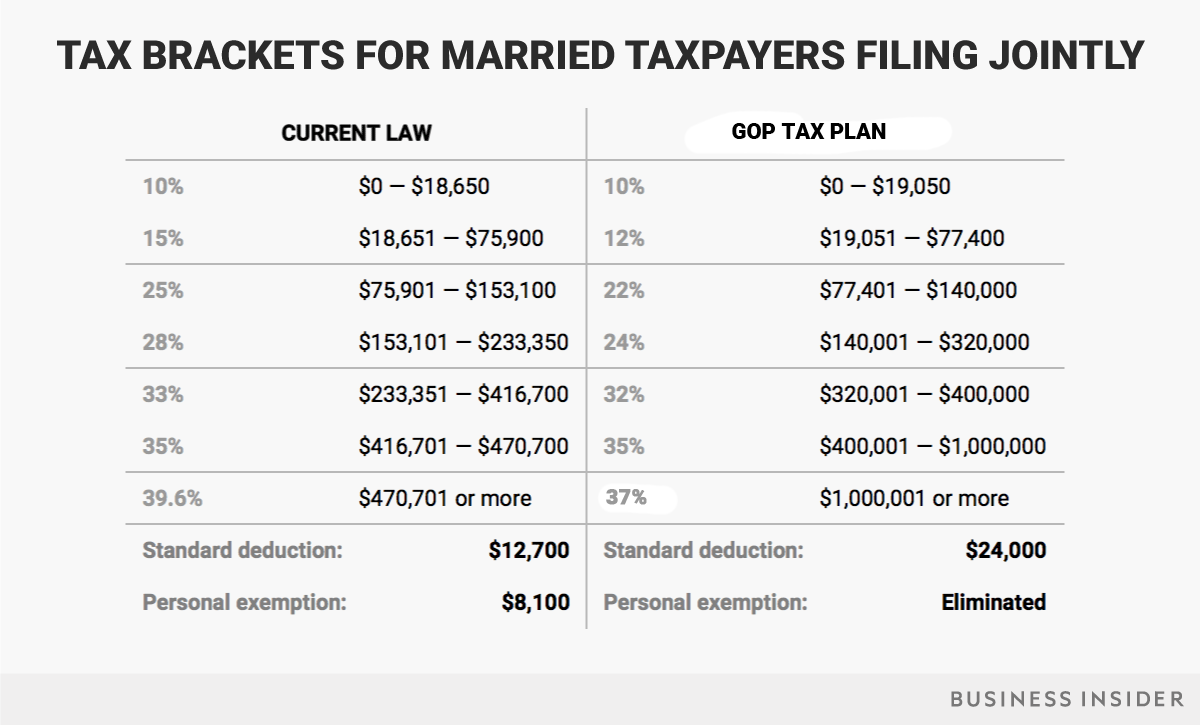

New tax brackets also from Business Insider:

Congress hopes to deliver the bill to the President for his signature before Christmas.